Some guy wants to shoot you in the eye with a laser: what could possibly go wrong?

A new token debuts this month, straight out of the pages of a sci-fi movie. With all the hype about artificial intelligence (AI), ChatGPT and clever computers that think they are sentient, the WorldCoin founders want to ensure you are really human. (This is in addition to how the robots test us to see if we are not a robot, a.k.a. clicking on pictures of motorbikes.)

In the marketing, the tech boffins tell you that it is all super simple: you get your retina scanned by one of their giant machines (called “the orb”), and it recognises you are an actual human with a natural retina. Your data is then matched, encrypted and stored, so you can always prove that you are the real you and not a machine or an imposter. (We are now coining the phrase “Orbwellian future”; remember you saw it here first.)

The WorldCoin team claim the provable ID will be handy for future interactions where you have to prove that you are human and not a robot. As we already have facial or fingerprint recognition on our smart devices, 2FA and a plethora of passwords, us puppies secretly feel that the retinal scan may be unnecessary…

On the plus side, it may be handy to prove you are human in the Metaverse (will it ever happen in a meaningful way), and not a robot player. Blockchain-encrypted iris scans could also be helpful for financial systems to prevent fraud; but again, we already have passwords, face and fingerprint recognition and 2FA.

Millions of people disagree with us: over two million people have already signed up to have their eyeballs shot with a laser blaster. Volunteers are rewarded with 25 WLD tokens, currently worth around $3. But before you agree to the procedure, here are some things you should know.

1. Stored biometric data on a centralised server may be a goldmine for hackers. WLD encrypts your personal data, but whatever is made secret could be discovered. (For those who use fingerprint or facial recognition on a smartphone, your data is encrypted and stored securely on your phone; it is NOT sent to Apple or Android servers.)

2. Trusting a central authority to keep your data is risky and flies in the face of the crypto ethos: decentralization, not centralisation. Do not trust; verify.

3. There is the possibility that rogue operators may insert additional data into the WLD system, thereby creating fake human identities for their own gain. We have seen this numerous times where so-called “influencers” pay to look good by having thousands of fake followers. There are also hundreds of thousands of “bots” on Twitter who spend all day and night praising the former president, plus the case where JP Morgan paid millions of dollars for an Edutech company that was 90% fake, with over four million fake student accounts.

4. Receiving $75 seems nice, until you spend it tomorrow. Your human biometric data is stored forever, and you might be unable to delete it.

5. There are currently only 200 orbs available to scan people (WLD hopes to make 1500 by the end of 2023). Scanning is available only in 35 cities in 20 countries. This gives a higher exposure to city dwellers, whilst rural people and those in poorer areas may be massively underrepresented.

6. The creation of WLD and the orb is supposed to protect humans from sentient AI robots like ChatGPT. However, the founder of WLD is also the CEO of OpenAI, who created ChatGPT. Stay alert: in this Orbwellian future, the person promising you a vaccine cure may be the same person who just made the disease…

7. Vitalik Buterin, the founder of the Ethereum network, has expressed several concerns about WLD, including the above. He proposes alternate solutions, including using existing locally-secured biometric data (i.e. your fingerprint and facial recognition that stay on your device) and having a social-graph solution. Each human person has unique social connections: friends, family, neighbours, employers and so on; even twins that share DNA would not have precisely the same social circles.

Assuming that you are, in fact, an actual human, not a robot, you have free will. If you wish, you can have your eyes lasered and stored with the father of Skynet, ahem, correction, ChatGPT. Enjoy the $75 bonus by all means. As for us, we will look for alternate solutions that are already proven and do not require trusting a centralised server. Remember, as we say on the Cryllionaire site, for a cryptocurrency to have long-term growth, it must have a unique offering.

Simplifying the complex

Still with Vitalik for a moment, the ETH founder wants to make crypto as simple as email.

Anyone on the internet in the early 1990s knows it was quite an ordeal to get connected and even harder to find out what you wanted to know. Long before Google was invented, the elders of the internet had to use primitive tools such as dial-up 9k modems and conduct searches using Webcrawler or Yahoo. Yes, younglings, it was much like the baby Flintstone using a mammoth bone for a scrunchie.

The internet was something you had to schedule time for: turning off call-waiting on your landline phone, making sure nobody was trying to call you, then dialling in, waiting for a connection, trying a search or waiting for your emails to come in. God forbid someone sent you an image or an audio file; those could take several hours or even several days to download.

Nowadays, we have instant internet in the palm of our hands, and most people do not even realise they are using the world wide web. Announcing “I’m going on the internet” was a source of pride in the 90s; if you said that now, people would look at you funny.

The early days of crypto were similarly very clunky. Wallets and exchanges have come a long way in the last few years, but we are still limited by writing passwords and seedphrases on old-fashioned paper.

If ETH can pull off a secure way of storing and managing seedphrases without compromising security, they will have taken a bold step in democratising cryptocurrency for the masses.

Currently, if you lose your seedphrase, you have lost all your crypto. If you do not have your seedphrase stored securely where your next of kin can find it on your death, then your funds have also been lost. It is estimated that almost 15% of all Bitcoin has been lost over the last decade through one in every seven people losing their seedphrases or not passing them on.

Whilst it is a significant security risk to store your seedphrase online due to the risk of hackers, if ETH finds a way to digitise, encrypt and securely store your information, it will be a big win for the entire community and mass adoption.

Good news out of Africa

Most people will recall that Zimbabwe suffered massive hyperinflation in the last 10-15 years, with prices of goods rising hourly. The government reset the currency a few times after inflation peaked at around 69 septillion percent, wiping nine zeroes off the end of banknotes to make inflation seem a more manageable 100 billion percent.

After trying another reset with the USD as a national currency and then again with their own Zim dollars (spoiler alert: it hyperinflated again), the government finally came around to the idea of a deflationary currency backed by gold in early 2022.

Droves of Zimbabweans have also discovered cryptocurrency. Even though the Zim government banned crypto, locals have used VPNs to access foreign websites and exchanges to purchase crypto. This can be then sent to friends and family or to buy goods using Wattsapp, Telegram and other channels that the government cannot monitor.

As few locals trust the Zim government to protect the paper currency, and there are concerns that the gold-backed currency may be corruptible or not-as-backed-as-you-may-think, crypto is an obvious solution: independent worldwide money without government control.

El Salvador has used Bitcoin as its national currency since 2021, with mixed results, and we await the adoption by other countries who may distrust their governments, the WEF or the IMF. Given the choice between a piece of paper that can only be used locally and may be inflated or devalued on the whim of politicians and bankers, or something truly worldwide and independent of control, what would you choose?

More good news: Ripple makes a splash

The court battle of the SEC versus Ripple (XRP) has been going on for some three years, and crypto may finally have a win. A judge in the US District Court has eventually ruled that Ripple Lab’s XRP is not a security and not subject to SEC regulation… probably.

The fine print is that XRP is not classified as a security when sold to ordinary retail investors, but could be classified as a security when sold to institutions or VC companies. This was seen as excellent news for ordinary XRP investors, and tokens surged some 80% on the news before settling down a few points as some investors took profits.

Crypto fans applauded the news that XRP would be relisted on Coinbase, and stock in Coinbase also rose on the news. Many cryptocurrencies that the SEC regulators were targeting also climbed as a precedent was set that cryptocurrencies may not be the same as stocks. New ‘crypto-specific’ legislation may still have to be put into law, and maybe the SEC will finally back off crypto to focus on stocks and ETFs.

Cops catch up to crypto criminals

US law enforcement finally arrested the former CEO of FTX, Sam Bankman-Fried (also known as Scam Bankrun-Fraud), in late 2022. Finally, after more than six months, the Australian regulators at ASIC decided to cancel the license of FTX Australia.

It would have been handy if ASIC had done it a year earlier, but apparently, it is better to lock the door after the dog has bolted than to never lock it at all.

In other news, the CEO of bankrupt crypto firm Celsius, Alex Mashinsky, has also been arrested and charged with multiple counts of fraud. If found guilty on all charges, Mashinsky and his 2IC each face up to 115 years in prison. Similar charges were laid against stock market fraud Bernie Madoff in 2009, who was sentenced to 150 years and died in prison. (Interestingly, the godfather of financial fraud, Charles Ponzi, was only sentenced to five years.)

Many companies go bankrupt through mismanagement or bad luck, but justice must be done when investors suffer losses due to massive deception. Seeing SBF and Mashinsky behind bars forever may not bring back your money, but it may bring you some satisfaction.

And, they’re off! The race to worldwide crypto

Two big things are affecting markets this month: the win by XRP that affects many other cryptocurrencies, and the race to have a Bitcoin ETF.

The world’s largest fund manager, BlackRock already has exchange-traded funds (ETFs) for US stocks, international stocks, gold, silver, copper and many other assets, so why not an ETF for Bitcoin?

Bitcoin funds have been approved in Canada, Dubai and Brazil, but the USA has had to make do with a Bitcoin futures fund (the current US fund does not hold Bitcoin, instead it has various contracts to buy or sell it at agreed prices).

Many applications have been submitted to the SEC for a spot Bitcoin ETF that would actually buy and hold the underlying asset. This would make it possible for institutions to invest into Bitcoin without creating a wallet address and seedphrase, in much the same way that Gold ETF holders can buy and sell pieces of paper linked to the gold price without having to take delivery of the metal.

Background sources indicate that anonymous institutions have been buying up Bitcoin quietly in the background while waiting for approval, as the price will likely be much higher after approval is granted.

It is possible that as many as five Bitcoin ETFs may receive approval in the USA, whilst twice as many others have already been knocked back. Government regulators are insisting that investors into the crypto ETFs are correctly identified, ratified and proven not to be the Unabomber, so there will likely be more rules incoming.

Whilst new regulations may seem cumbersome to those who have been in crypto for a few years, we feel that whatever brings crypto to the masses is good for everyone.

The price of Bitcoin, whilst down a little for the month, is almost double what it was in November last year. Other SEC-targeted tokens such as Solana, XRP, BNB, Cardano and Tron are up over 100% for the year.

How did we do?

Markets continue to recover from their 2022 lows, and aspire to new all-time highs, buoyed by the introduction of Wall Street’s biggest names to cryptocurrency.

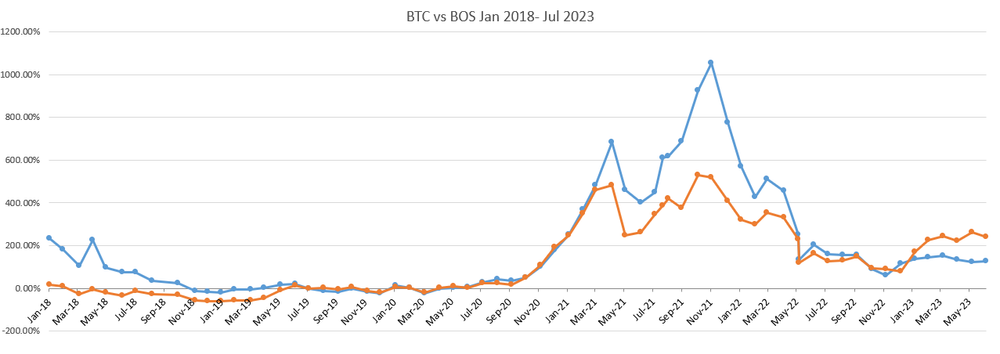

Bostoncoin: Bitcoin is up 88%, Ethereum up 66%, and XRP is up 275% from last year. Our investment in LINK is up 84% in just one month. Stalwart BAT is up 310% for the year.

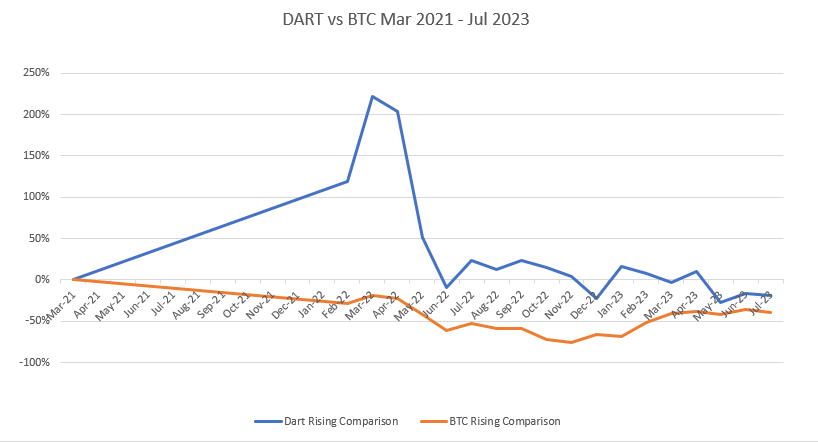

DARTcoin: BNB is up 28%, QNT up 58%, and RNDR is up 365% for the year.

We look forward to what happens when the Wall St crypto permits are granted, not just proposed. See you next month!

JB

As at July 31 2023

BOS Price AUD 68.7365478

BOS Price USD 47.0328695

July 31 2023

DART Price AUD 81.0679643

DART Price USD 54.2587885