Bostoncoin update Mar-Apr 2024

Banzai! Japan wakes up. What is DePin?

Hey kids, remember Japan? They used to be famous for creating amazing technology and tiny appliances, such as the Sony Walkman, various Nintendo gaming systems, and a brave little robot called Astroboy.

Post-WWII, the Japanese pioneered many amazing technologies that we still use today, including silicon chips and lithium-ion batteries. Yes, they did create the first robots in the 1970s, revolutionising many industries, including automotive and manufacturing. This spawned robot pets, robot helpers, robot factory workers, and an entire movie industry.

Fifty years later, an eccentric American ringmaster, Elon Musk, dressed a man in a robot suit and tried to convince investors it was real. It appears that America cannot compete with Japan on tech but still leads the world in hucksters.

After a few decades of creating many incredible inventions and making billions of dollars, Japan basically imploded. In 1990, Japanese companies were making bids to buy European and American computer manufacturers, sparking fears of fiscal takeover, and Japanese businessmen were buying up as much land as possible in the west.

One Japanese firm invested over $2 billion in Queensland property, another firm paid over $3 billion for New York’s Rockefeller Centre, and a single Japanese man paid over $1.6 billion for California’s Pebble Beach Golf Course. A few years later, both the Rockefeller Centre and the golf course were repossessed for half the price.

After growing too big, too fast, the Japanese economy collapsed, asset prices plummeted, and, from 1991, Japan experienced three recessions in just ten years. Due to woeful demographic and monetary policies, the “lost decade” ultimately became “the lost three decades,” with poor GDP and negative interest rates.

During the “lost years”, in Japan, investors were charged interest for putting funds into banks or government bonds. Negative interest rates meant that $100 000 invested would become $97 000. It sounds unbelievable, but this was seen as a sensible monetary policy by the government and a way to deal with the crazy excesses of the 1980s and 1990s.

After decades of flat progress, Japan is starting to wake up, and just in the nick of time. Bank interest rates that have been negative for many years are now positive. Japanese investors who were basically forced to invest in the West for yield can now bring their funds back home.

This repatriating of funds may negatively affect the value of the US dollar as investors sell USD to purchase yen or other currencies. Japan is the largest lender to the USA ($1.1 trillion), beating China ($800 billion) and the UK ($700 billion). Funds outflow from the USA to Asia could devalue the USD and increase the value of other currencies, including cryptocurrencies.

Japan has a rapidly aging population. With more retirees and less workers, there will be a drain on taxes and pension funds, unless the Japanese can make their money work a lot harder than they do.

Making the money work harder is the plan. As the Japanese economy starts to go into the green for the first time in 30 years, the world’s largest pension fund is considering diversification into crypto. The Japanese GPIF (Government Pension Investment Fund) has over $1.5 trillion under management and just announced they are looking to diversify into cryptocurrency.

If you know the famous Japanese image of the tsunami, imagine it as a tidal wave of wealth in fiat currency that is about to crash into crypto markets. Be prepared for things to get very choppy very quickly. Sudden inflows can lift prices very high, but there will also be brief stomach-churning drops as investors take profits. Stick with your plan and your timeframe, and resist any urge to panic. We are here for the long-haul.

What is DePin?

Cryptocurrency changes things, including language. Back in 2016-2017 we had many new coins coming to the market, in what was called an ICO or Initial Coin Offering. The ICO craze was followed by DeFi (Decentralized Finance), NFTs (Non-Fungible Tokens), CEX’s and DEX’s (Centralised Exchanges and Decentralized Exchanges), among other acronyms.

The new buzzword is DePin or Decentralized Physical Infrastructure.

For decades, investors have been able to put funds into “alternative assets” that did not fit into the regular box of property, bonds, stocks or cash. Some people have poured millions into windmill farms, wave farms, and underground tunnels, but these assets were not as easy to buy and sell as stocks and shares.

Enter DePin.

On the surface, DePin is as simple as carving up a physical asset into thousands or millions of units and selling them off as if they were stocks. You can then own one-millionth of a windmill, tunnel, bridge or solar farm. This makes buying or selling much quicker and easier, as you are transacting on a token that represents partial ownership and not the entire asset.

We have seen other decentralized ownership functionality in the world of fine arts, such as buying a fractionalized share in an oil painting.

It makes sense that it is easier to sell a handful of stocks in a company rather than trying to find a buyer for the entire company. Thanks to blockchain technology, each token can be tracked and verified, giving full transparency and trust to buyers and sellers. Stay tuned for more as we could gradually see millions more assets being fractionalized and tokenized on the blockchain. Why buy the whole cow when you can simply buy 0.03% of the farm?

Leading the way in DePin are our old friends at Blackrock. They launched a Bitcoin monofunds, are planning on an Ethereum monofunds, and have already started on the Blackrock DePin fund.

If you do not understand it, or do not have time to research it, there is no reason to think you are missing out. The Blackrock DePin fund will be running on the Ethereum network, so ETH demand should rise again just as it did during the NFT craze.

As serious investors with an eye on utility and liquidity, the Bostoncoin fund and DARTcoin fund did not invest into any NFTs or memecoins. After their value crashed 99%, we were proven correct in our strategy.

Meanwhile, people are going crazy over the next batch of memecoins that are being created on the Solana network. We do not concern ourselves with a memecoin that is trending this week and gone by next week, as we invest into the underlying assets and networks. A memecoin can rise a million percent in a week and go to zero a few days later, but the network makes money every day.

How did we go this month?

The Bostoncoin fund continues to grow nicely, as our flagship fund enters its ninth year of operation. If you are wondering what to send for our next birthday, think about chocolate cake with ten candles

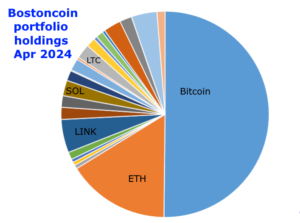

Above is a snapshot of the Bostoncoin portfolio on the last day of March 2024. The portfolio changes daily, and you can see the mix in real-time with full transparency by clicking here. We are very proud of this, and love to show it off. No other fund manager does this, so have a look and show your friends.

This month BOS saw gains from

Solana up 954%

Injective up 799%

Chainlink up 260%

Cronos up 218%

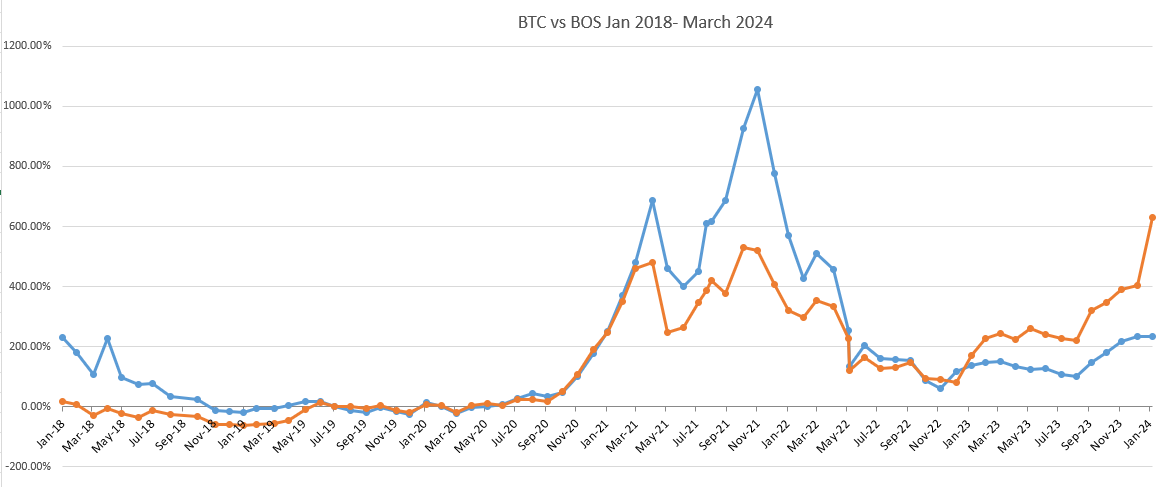

The BOS token is up 25% since March 2023, and up 400% since March 2020. Due to the launch of a dozen Bitcoin monofunds this year, the Bostoncoin fund has underperformed Bitcoin for the first time in nine years. We aim to regain the crown over the next twelve months and continue to outperform Bitcoin with less volatility.

As at March 31 2024

BOS Price AUD 92.6418088195

BOS Price USD 60.287234

How did DART go?

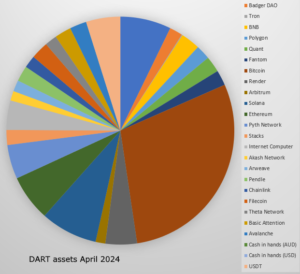

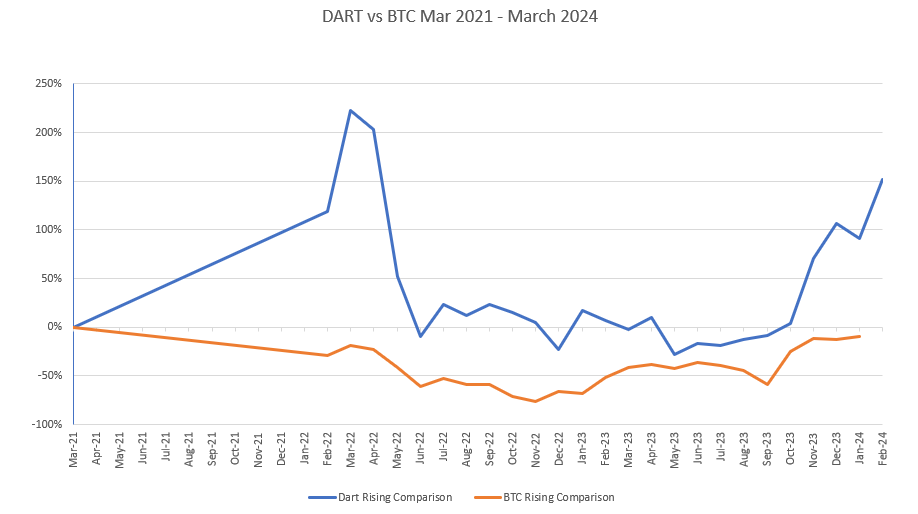

The DARTcoin fund recently celebrated its anniversary also, and is now three years old. DART continues to outperform Bitcoin, but with more volatility than BOS.

This month DART saw gains from

Akash up 1610%

Pendle up 1523%

Render up 862%

Rune up 637%

The DART token is up 302% since 2023, and up 297% from 2021. Compare that to what is possible from many other investments and then brag to your friends. When your friends invest, we will send you a thankyou gift, and in all honesty, they should thank you for the introduction

As at March 31 2024

DART Price AUD 294.2965955257

DART Price USD 191.53171

As crypto markets exit winter and bloom into a grand new spring season, expect a rise in people who want to take your money from you. Remember to be highly suspicious of what you cannot verify through the blockchain or legitimate news services. Do not share passwords or seed phrases, do not click on links in text messages or emails and please store your crypto on a hardware wallet to protect it from hackers, crackers, scammers and flim-flammers. We are always here to help you with any questions. Stay safe and we will see you next month.

JB

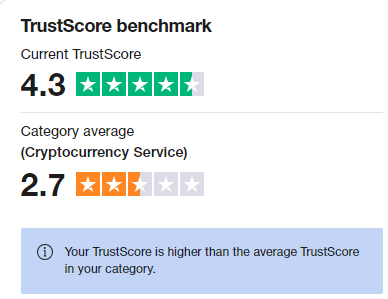

PS – if you’re an investor and you have not yet given us a review on TrustPilot, please take 60 seconds to do that here. Seeing your review makes us feel good, and also helps others to know what to expect. Let’s face it: crypto often gets a bad rap due to some silly people doing silly things. We want the world to know that we do crypto differently.