Bostoncoin update May-June 2023

Fear-mongering at its finest

If your enemies run out of evidence against you and start spreading malicious lies, it could be an indicator that you are on the right side, and they are definitely in the wrong. Bitcoin fans have all heard the misinformation and fear-mongering such as, “Bitcoin is bad for the environment” or “Bitcoin mining uses more electricity than New Zealand”, but wait, there’s more…

The first claim is false, baseless and easily disproven, as there are a plethora of sustainable crypto mining operations, using volcanoes, solar power, wind farms, ocean wave energy, oil and gas refinery overflows and even Himalayan hydroelectricity (the government in Bhutan is amazing!).

Fact: almost two-thirds of Bitcoin miners use sustainable or renewable energy, and many things use more electricity than New Zealand, such as my partner’s electric blanket on a cool evening, any three electric cars going uphill, and oh yeah, the massively convoluted and largely redundant global banking system.

Unless you want to compare apples with orangutans, you cannot draw any parallels between worldwide total crypto and tiddly little Kiwis (0.0005% of the world population).

This month we saw *almost* the most ridiculous argument proposed by no less than The New York Times, who claimed that, because of Bitcoin mining, there is not enough energy left in the USA to provide power to cat shelters. Yes, the author claimed that Bitcoin miners are killing kittens. What is that overcoming adversity quote? First, they laugh at you, then they ridicule you, then they accuse you of murdering small fluffy animals?

This feckless ‘cats versus crypto’ claim would have been crazy enough, but not to be outdone, we heard an even wilder quote from US Congressman Brad Sherman, Chairman of the House Financial Services Subcommittee on Capital Markets and Investor Protection. Mister Sherman, assuming he can spell all his titles, should really be an educated chap, but his defence of the USA not embracing new technology was, at best, insulting to several nations as well as to rational intelligence.

Told that China, Hong Kong, Singapore and other nations were embracing crypto and making new crypto regulations, whilst the USA was lagging far behind, Rep Sherman claimed that “Peru is way ahead of [the USA] in cocaine production. China is way ahead of us in organ harvesting. We don’t need to keep up on those things and we don’t need to keep up on crypto”.

OK, so now we have someone at one of the USA’s premier news journals claiming that Bitcoin kills kittens, and an elected politician who compares the world-changing new technology of crypto to the grisly practice of organ harvesting. It could not get any more bizarre.

Spoiler alert: in the end, the truth comes out and the nay-sayers eat crow.

China leads the world, USA failing

In China, the yuan just overtook the US dollar as the most widely used currency for international trade.

China has essentially been the manufacturer of the world for decades and does business with nearly every country on the planet. Yet, up until last month, most of China’s trade was conducted in US dollars. If a Chinese manufacturer sold machinery to a Brazilian company, or if a Chinese producer bought cobalt from Indonesia, those transactions traditionally took place in US dollars.

Over time, however, China has been gradually using its own currency for trade, with other countries happy to go along.

So now, for example, China might buy cobalt from Indonesia using yuan instead of US dollars. This means that other countries will start holding more and more yuan to trade with China… and fewer and fewer US dollars.

This is not an accident. Back in 1944, the US was very aggressive in whipping the rest of the world into accepting the US dollar. China is following the same playbook: aggressively rallying other countries against the US dollar and towards the yuan.

After a recent visit to China, French President Macron urged Europe to move towards independence from US foreign policy, and to rely less on the US dollar. France… which is literally America’s oldest ally, one of the largest economies in Europe, and a key leader of the European Union, is pushing against the US dollar.

In addition, China and France recently completed their first yuan-settled LNG (liquified natural gas) trade. Again, this shows a shift from France solely using the US dollar for foreign trade, to also using the yuan. Just before that, China and the United Arab Emirates made history with the first ever LNG trade settled in yuan. Then Brazil and China reached a deal to ditch the US dollar and trade in their own currencies.

Malaysia’s Prime Minister has proposed an “Asian Monetary Fund” to reduce dependence on the US dollar. Malaysia also struck a deal with India to trade in the Indian rupee. India and Russia are settling oil deals without US dollars.

Then there is “BRICS”— Brazil, Russia, India, China, and South Africa which account for about 40% of the global population and a quarter of the global economy. At a Bretton Woods-esque summit planned for this summer, BRICS will discuss creating a new currency, potentially pegged to gold, which they can use to trade.

Most importantly, Saudi Arabia is open to breaking the petrodollar and to start selling oil in yuan. On top of this, Saudi’s crown prince recently stated that he was “no longer interested in pleasing the US”.

(Thanks to Simon Black @ ,Sovereignman.com for the China article. As China has been using the digital e-yuan for two years, and Hong Kong will now allow retail investors to buy crypto, it seems likely the USD may fall and crypto will rise. We will be watching with interest!)

n

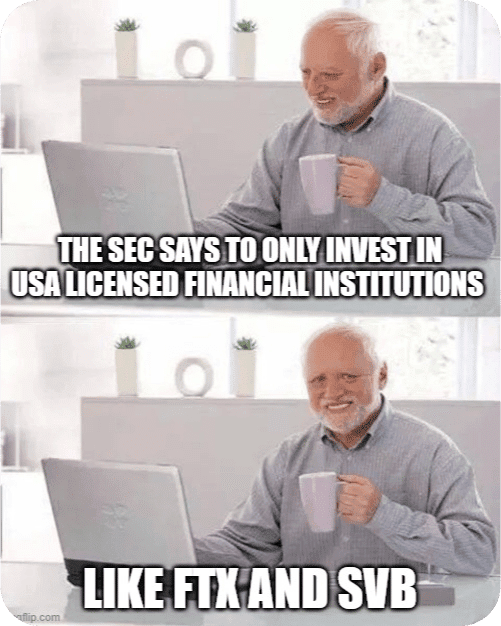

Safe as backward banks?

In the wake of several recent bank collapses in the USA, the government would like to remind citizens that, despite all evidence to the contrary, cash is way better than cryptocurrencies (especially as cash never killed your kittens or stole your spleen, right Mr Sherman?)

However, the government previously advised the majority of businesses to stop taking cash because notes (allegedly) carried coronavirus. So if cash causes coughing and crypto kills kittens, what do people use instead? Gift cards.

And how do we buy those gift cards? At a “reverse ATM”. This new invention does what it says on the box: instead of putting in a plastic card and getting out cash, like a regular ATM, the ‘reverse’ customers put in cash and get out a plastic card.

The increase in reverse ATMs is in part, a response to privacy concerns. Some people prefer the anonymity of paying cash, as they fear that authorities may be looking into their bank accounts and tracking transactions.

If you are the type of person who worries that a federal agency may be looking into your $299 sneaker purchase, you can load $305 into a reverse ATM, get a $300 gift card and shop anonymously. (Yes, the machine often charges a $5 fee for conversion).

Aside from privacy, the machines may also appeal to the “unbanked”; those who do not have bank accounts or regular credit cards. The reverse ATM article suggests that there may be 4-5% of the US population who are unbanked, makes no mention of other nations (because “Murica!”) and does not address the issue of money laundering.

Perhaps the government assumes that criminals will not use reverse ATMs to turn their dirty cash into prepaid Mastercards, Visa cards and store gift cards, because the criminals already have a network of fake dry cleaners and “Breaking Bad” car washes?

Pro Tip: if you are waiting in line at a reverse ATM and the person in front of you is carrying a large brown paper bag, or a bulging leather briefcase, maybe find another queue.

Meanwhile, to the surprise of many in the USA, there actually are other countries in the world… Morocco has around 70% of its population without bank accounts, followed by Vietnam, the Philippines, Egypt, Mexico and Nigeria all in the 60-70% bracket. Peru, Columbia, Indonesia, Zimbabwe and Argentina all have more than half of their populations without a bank account.

Savvy investors may now be thinking one of two things:

-

- n

- if the death of paper currency has started, and everything is going digital, perhaps I should buy a reverse ATM and install it in one of the above countries, or

n

-

- these massively underbanked nations are all prime for crypto adoption; maybe I should get hold of as much crypto as I can and just wait.

n

We provide education, not financial advice, so there is no official recommendation either way. However, before deciding whether to invest into a coffin-sized ATM or a million in crypto on a pocket-sized device, consider the challenge of taking it with you when you travel.

Also consider, despite the fact that 50-60% of Zimbabweans do not have a bank account, the country has not rolled out reverse ATMs. The Zim government are turning their backs on unbacked fiat currency, and has released a gold-backed cryptocurrency.

Yes, the African nation that a decade ago had 80 septillion percent inflation, is going all the way back to the good old days when a dollar was actually backed by precious metal. If you have been paying attention, you will realise that Zimbabwe is joining the likes of the BRICS nations, who are backing off from the USD and eschewing unbacked paper currencies.

Understandably, the IMF is not happy to be losing control of the money supply of so many nations, but what are they going to do about it? At the end of the day, the USA is a business, and the US dollar is a product. If the general public no longer like your product, all the bombs and guns in the world are ineffective coercion. Maybe it’s time to change the product, and introduce a gold-backed USD, or a cryptocurrency, before the rest of the world changes suppliers? We can hope the once powerful US empire catches on quickly to the winds of change, before the US stranglehold on world trade becomes nothing but a trembling hand.

Ledger: what the hell are you doing?

Long seen as the gold standard of offline crypto storage, Ledger recently screwed up their marketing with a new offer to keep customer’s private keys and 12- or 24-word seedphrase on its servers.

Anyone who has been in crypto longer than eight minutes knows that you NEVER put your seedphrase on the internet, or where anyone else can find it. If anyone discovers your seedphrase, all your crypto can be stolen, with zero recourse.

In defence of Ledger, they were trying to appeal to a certain market: people who have trouble writing words on a piece of paper and storing them in a safe place.

There may also be some people who wrote down the words and stored them securely without labelling what the words mean, to which wallet they are connected, or there may be those who stored their seedphrase in such a secure place that even they don’t know where it is…

Some crypto kids threw tantrums, called Ledger bad names and vowed to throw out their expensive devices and never use the company or its products again.

It is important to realise that the “keep your keys with us” service was an opt-in (optional) service charging $9 per month, and nobody is forced to take up the offer.

For those who lack the ability to securely store their own seedphrase, Ledger practices “sharding”, which is basically tearing the seedphrase into three parts, and storing the parts or shards at three separate locations. This makes it very difficult for any hackers to discover your keys, as they would literally have to hack all three networks at once. Not impossible, but prohibitively expensive and statistically unlikely.

Paying $9 a month is only the first step, and aside from the remotely miniscule risk of online hacking, many crypto kids are upset that there are KYC (Know Your Customer) rules involved, just as there are with most crypto exchanges.

If you lost your seedphrase and want to get your crypto back, Ledger needs to prove that you are really you, and not an imposter. This involves using various forms of proof of identity, and many crypto holders wish to remain anonymous.

Aim to see both sides of the story and not get caught up in the FUD (Fear, Uncertainty, Doubt) thrown on both sides. You alone are the best judge of whether you wish to take on a little online risk for greater peace of mind, or whether you prefer to handle all the risk yourself by holding your crypto keys offline.

Whatever service you choose, we still like Ledger and its products, but will probably not use the new opt-in service whilst we have several laminated backups in fireproof and flood-proof safes in secret locations.

If you do not yet have a Ledger to safely store your crypto offline, you can get one here. We promise not to judge you, whether you use online or offline backup. The main thing is to have a cold wallet and not store your crypto on exchanges.

Last but not least

Tether, famous for its stablecoin USDT, is now purchasing Bitcoin; possibly because they fear the decline in value of the fiat USD. Around 15% of Tether’s profits will now be put into purchasing BTC each month. This is good news for BTC price and market stability, and perhaps a reminder not to have all your funds in cash.

In a bold move, the UK government wants to classify crypto as gambling, rather than regulating crypto as stocks or commodities. This may be a quick and easy way to create instant legislation without drawing up new laws, and may make crypto profits non-taxable. The proposal has riled IOSCO, the International Organization of Securities Commissions, which likes to police world stock markets, and also wants to control cryptocurrencies globally. Whether crypto legislators decide tokens are stocks, commodities or casino chips is of little consequence to most holders, but the authorities need to justify their existence, and that’s fine.

As crypto regulators make tighter controls in other countries, Binance exited Canada completely, and Westpac (WBC) halted fiat on-ramps to Binance Australia. Canadian crypto fans will have to use other exchanges (or a VPN) and Binance does not have to bow to regulators in the great white North.

As for the Aussies, they can still put cash into Binance using debit cards, but not bank transfers, so purchasing new crypto is still possible. As for getting cash out of the exchange and into your bank account… well, there is always the CRO prepaid Visa card that can be topped up with crypto and used to pay for goods and services at 44 million Visa merchants in 200 countries.

Joining Nike and many other household names, Mercedes is now launching NFTs on the blockchain. Despite some ignoramuses claiming that crypto kills cats, destroys the environment or is akin to someone stealing your liver, it seems that the crypto network just keeps getting larger and more mainstream.

If your friends and family are not into crypto yet, that means they still have time to make gains before mass adoption occurs. Tell your uninitiated friends to call us, visit the website or send them a few newsletter links. All existing Bostoncoin investors can now qualify for an affiliate link, so you can share your love of Bostoncoin and gain bonus rewards in cash or crypto.

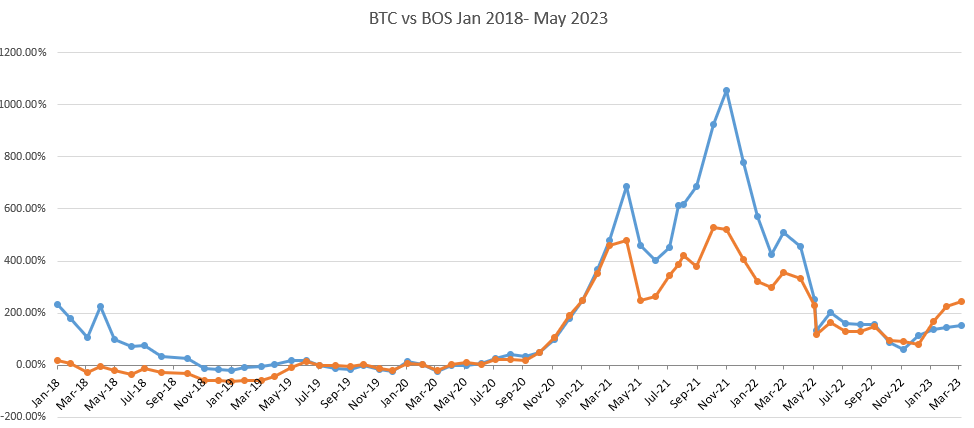

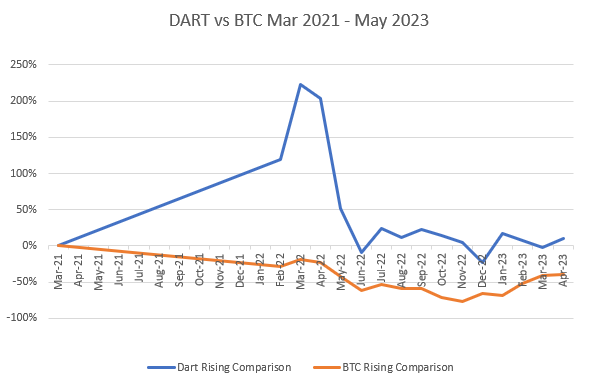

How are we going?

Things are improving slowly in cryptopia, with Bitcoin recovering a lot from its lows of 2022; up around 62%. Our holdings in MATIC are up 148% and QANT up 177%in the last year. As of 1 June 2023, retail investors in Hong Kong are permitted to buy cryptocurrencies, so we are expecting an increase over the next six months from Asia. The next Bitcoin halving will occur in mid-next year, so that is also exciting.

After the 2012 halving, prices rose over 1000% in six months. Eighteen months after the 2016 halving, BTC prices were up another 2962%, and a year after the 2020 halving, BTC reached its second-highest peak of over 1000% again. Stay tuned, grab the popcorn and invite some friends to the Bostoncoin party. We think it is going to be a wild ride!

As at May 31 2023

BOS NAV USD 44.015855

BOS Price USD 48.4174405

BOS NAV AUD 63.7910994

BOS Price AUD 70.1702094

May 31 2023

DART NAV USD 42.552726

DART Price USD 46.804752

DART NAV AUD 65.5488037

DART Price AUD 72.1036841