Bostoncoin update Oct-Nov 2022

Where in the world is Bitcoin van der Crypto?

Those of a certain age and certain background (OK, nerds over 30) may recall a computer adventure game called “Where in the World is Carmen Sandiego?”

Designed as a clue-solving puzzle game for kids, it became popular in schools as teachers realized students could learn geography, problem-solving, cultural empathy, gender equality and many other valuable skills (not uselessly shooting at zombies!)

The famous femme fatale franchise “Carmen Sandiego” went on to multiple sequels in computer gaming as well as hard games, publications and a TV show that won several Emmy and Peabody awards. If you have kids whom you want to trick into learning things whilst having fun, investigate the Carmen Sandiego TV show, comics, books, computer games and board games.

The character herself, Carmen Sandiego is a powerful, independent and intelligent Latina woman who travels extensively; based on Brazilian triple-threat singer/dancer/actress Carmen Miranda. In her honour, we will start our crypto journey in Brazil.

What’s going on in Brazil?

In moves that seem to echo the world recently, southern American individuals are selling crypto to institutions. Who is the cleverest of them all?

The number of companies holding cryptocurrency in Brazil has reached new record highs amid an increased trust in cryptocurrencies and high inflation rates.

According to local media reports, the country’s taxation authority, Receita Federal do Brasil (RFB) — also known as the Federal Revenue of Brazil — recorded 12,053 unique organizations declaring crypto on their balance sheets in Aug/Sept 2022.

Meanwhile, the number of individual Brazilian investors holding crypto fell from the prior month, down to 1.3 million.

Brazilians’ trust in cryptocurrency remains high, however, according to a September Bitstamp “Crypto Pulse” report, with 77% stating they trusted digital assets.

If you, or anyone you know, is selling crypto, please consider who is buying. All markets need buyers and sellers. If uninformed individuals are selling their crypto, and large, well-researched corporations are buying it, we may have a problem or two.

Decentralisation: Crypto is supposed to be decentralised and less able to be manipulated than traditional stock markets and banking markets. Putting more crypto in the hands of big businesses and less in the hands of individuals may put markets at risk of manipulation.

Money, money, money: yes, we support the crypto pillars of anonymity, individual power and freedom, decentralisation and deflationary currency. We also support the idea of making big money. Imagine if most of the stock in Apple, Tesla or Amazon were owned by big banks and Wall Street: individuals would have almost no chance of making it rich. We are not promising you big gains from your portfolio, but if the portfolio were to make massive gains, is that money better off in your hands or the hands of Wall Street bankers? Think before you let your crypto into the hands of powerful corporations.

Unshackling from USD: Crypto in Southern and Central America

A quick stopover from Brazil in neighbouring El Salvador. Long-term readers will know that we first discussed Central American nations getting into crypto, way back in early 2019, a good two years before the El Salvadorean president decided to be the first nation to adopt Bitcoin as an official currency.

Critics may say the experiment failed and El Salvador has lost money on the bold decision. Others may point out that many smaller nations’ currencies can be more volatile than cryptocurrency; particularly those at the mercy of the IMF, which can ,devalue a country’s currency on a whim.

Former comedian, motorcycle rider and self-confessed “cool guy”, El-Sal president Nayib Bukele is one of the world’s youngest leaders and one of the least politically conservative. Whether Bukele adopted gold, Bitcoin or coffee beans as a national currency, he would have faced criticism, particularly from the USA and the IMF: two entities who have the most to gain from keeping smaller nations under the heel of the USD.

A move away from inflationary, unbacked and externally-manipulated fiat currency may turn out to be a truly genius move for El Salvador. We must give Bukele time to see what happens.

Meanwhile, 16 politicians from other central and southern-American nations have shown positivity toward Bitcoin and cryptocurrency, with several leaders changing their Twitter profile pictures to “laser eyes”. Keep your eyes on Paraguay, Panama, Venezuela and Mexico, as these may be the next non-US American nations to eschew the USD and accept crypto as an official currency.

Waka waka

It’s time for Africa

A quick hop across the Atlantic Ocean from the American continent to the African continent, where we check in on the Central African Republic or CAR.

El Salvador adopted Bitcoin as legal tender in 2021, and CAR followed in April 2022. Which nation will be third?

The IMF has subtly suggested that CAR could also stand for “Close Ally of Russia” and has accused the Central African Republic of supporting Putin. One should take those accusations with a grain of salt, as the allegations may be impossible to prove, and the main thing that CAR is guilty of, is trying to escape the control of the US dollar, US/IMF sanctions and the US-controlled SWIFT system.

Throughout history, any group of persons who were enslaved, oppressed or colonised have faced ongoing battles even after becoming independent or free. Thankfully, allegations and accusations can be ignored, and the newly-empowered groups or individuals can freely go about their business, occasionally “sticking it to the man”. Success can be the best revenge.

As historians, we see current events as echoes of nations dissociating from the Roman Empire and the British Empire. Many nations who became independent in the past few centuries threw off the imperialist shackles and created their own laws, followed quickly by creating their own independent money.

Even the USA, after declaring independence from Britain, quickly switched from UK pounds, shilling and pence to the Spanish dollar, before creating their own colonial currency.

Ask yourself: if every person is equal and if every country in the world is connected via the internet, why should we allow a small group of individuals from just one country to control the world’s financial transactions?

(I will stand by my inbox waiting for any legitimate justifications for the empire of the USD, and expect none. Future generations may not even know what the acronyms USA or IMF mean, but they may well know what ,DAO stands for.)

Continuing our journey across continents, we move from the Americas and Africas to the Asia-Pacific region: the area of Crocodiles, Crikey and Crazy Rich Asians.

Asia Pacific

If you receive most of your news from English-language sources in Australia, UK and USA, you could think that the entire world is dealing with hyperinflation, higher interest rates and economic uncertainty. However, in the former economic powerhouse of the 1980’s, Japan still has rates of less than zero (-0.1%).

Whilst still recovering from the aftermath of COVID-19, Japan has found new markets in the west as USA places tighter regulations on purchasing silicon chips from China. One Japanese chip-maker surged 45% this month and other Japanese stocks seem to be recovering with the help of lower interest rates.

It makes sense that Japanese businesses will do better whilst interest rates are low, however, the economy itself may suffer due to a weakening yen: Japanese investors may choose to sell the local currency and buy USD, GBP or AUD so they can access higher bank savings rates with low risk. Obviously, continued selling of the yen will decrease the yen price, leading to many other challenges. If only someone would invent a currency that was not manipulated or centralised…

Rivalries between Japan and China, China and Hong Kong, and Asia versus the West have existed for centuries; we are not claiming that a decentralised cryptocurrency solution would fix all the regional and economic problems, but maybe we could implement it for a decade or so and see how many problems go away.

A trip through time and space

New coins for the old Kingdom

Before closing the world-wind tour, we whiz back around the globe from Asia to the UK, and remember happier times; specifically April 2022. It may seem like only six months ago, but for the citizens of the UK, in that time, they had three different prime ministers, four different chancellors, three different home secretaries, and two monarchs.

In April 2022, the then-chancellor of the UK, Rishi Sunak declared that the UK would become a global cryptoasset technology hub. Considering that London is often called the world’s banker, it makes sense for the UK to move with the times and embrace a new currency and payment system, rather than lose its financial stranglehold.

For those who have been paying attention, after a couple of false starts, tomfookery and fiascos, the UK now has a new Prime Minister: none other than Rishi Sunak, the former chancellor with a penchant for crypto. One does not need laser vision to see what could be coming up next on the horizon: crypto business hubs in London town, financial and tax incentives for blockchain companies to domicile in the UK and signs in ye old British pub saying “Pints of Bitter: pay in Bitcoin”.

As Carmen Sandiego travelled the world many times throughout the last 30 years, it would have been much easier for her to carry one worldwide currency than to be swapping paper notes and incurring exchange fees every few hundred miles. We may be biased, but we hope that the new UK “Prime Millennial”, the young Brazilian President and other crypto-friendly leaders succeed in their aims to topple the old guard.

Back to Boston

How did we go this month?

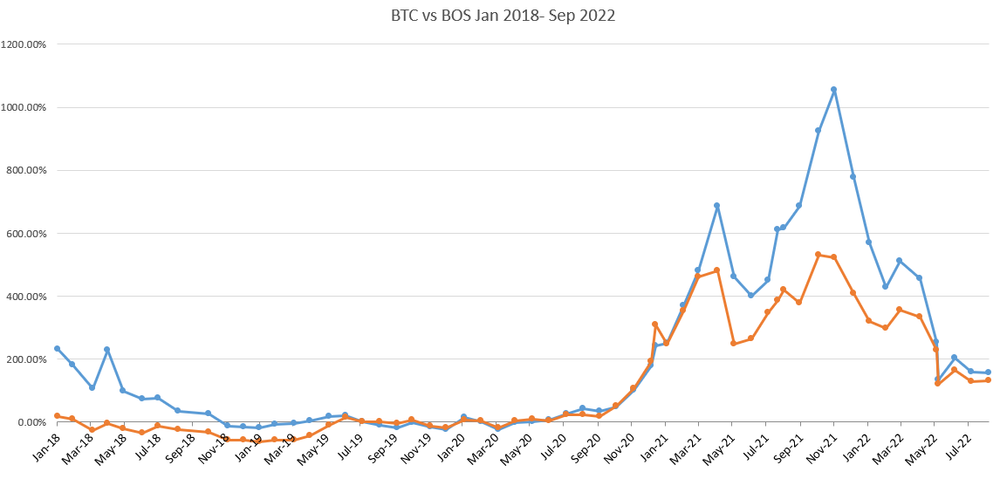

After the recent global market hammering caused by Russian war and higher interest rates, crypto markets have stabilised and are now slowly creeping back. Interestingly, there has been less volatility in crypto markets than in stock markets over the last couple of months: noteworthy indeed.

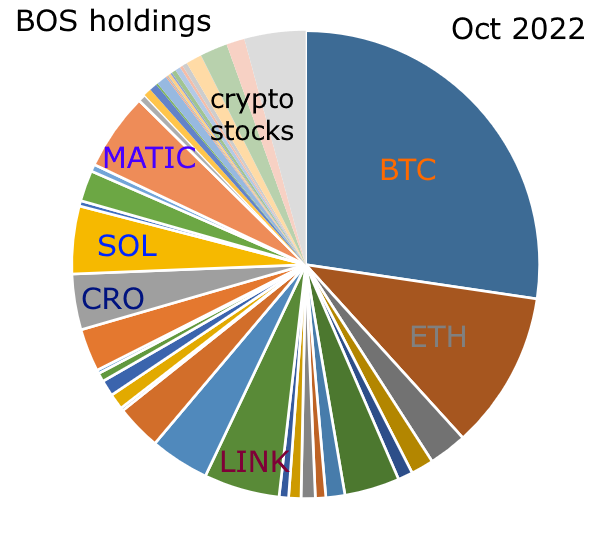

The so-called “ETH-killer” PolkaDot is up year on year, bucking the trend of almost all other cryptos. We have also seen gains from the following projects in the Bostoncoin fund:

TLC up 269%

CHZ up 203%

QNT up 251%

As at Oct 31 2022

BOS NAV 69.820623889

BOS Price 76.8026862779

Yes, this is a drop of around 50% from last year, in line with global crypto markets, however, for the diversified Bostoncoin crypto fund,

2-year return is 171%

3-year return is 261%

For the newer DARTcoin portfolio, there is less data as it has been available for less than a year. A modest return of around 27.3% for the last six months.

DART NAV 104.5150722534

DART Price 114.9665794787

As cryptocurrencies have grown from a fringe asset for computer nerds, to infiltrate mainstream investors, tech company billionaires and a couple of small nation governments, we envisage the sector growing even larger in the next few years.

Whether you are investing in stocks or into crypto: always look for real-world use-case scenarios. A snazzy name or trendy meme logo may look good to you today, but reliability and diversification will make you money over the longer term.

SWAG UPDATE: we have a small supply of Bostoncoin watches and T-shirts in sizes L and XL only. Introduce a friend to the world’s first crypto fund and we will send you some free BOS merchandise, subject to availability.

As always, stay safe, and reach out if you have any questions

See you next month

JB