BostonTrading.co update Jan 2024

2024: Chinese year of the dragon and the year that Bitcoin takes Wall Street

Happy New Year! As we step into 2024, let’s take a moment to reflect on the previous month in the cryptocurrency market. As the Boston puppies have been holidaying on beaches rather than writing six-page market summaries, here is just a quick overview.

Bitcoin Powers On:

Despite still facing regulatory uncertainties and market fluctuations, Bitcoin showcased its resilience by maintaining a steady course. The OG cryptocurrency continues to serve as a robust store of value in times of economic uncertainty.

As we write this, we are mere days away from a spot Bitcoin ETF approval by the SEC. If you don’t know what those words or acronyms mean, do not worry. It’s all good.

In a nutshell, for the past 15 years, any nerd with a seedphrase and a smartphone or PC has been able to buy crypto. Big institutions such as banks, pension funds, super funds and hedge funds have not been able to buy crypto, as they were predominantly set up to buy stocks.

A Bitcoin ETF (exchange-traded fund) means that bigger institutions can buy crypto, just as if it were a normal stock on the stock market. This increased buying ability does not guarantee that Wall Street will definitely buy, but it means that, for the first time ever, they can.

We could compare it to the olden days when people could buy physical bars of gold or gold coins and had to take delivery of the heavy asset. The gold price slowly increased over the years, but nothing much exciting happened until a gold ETF was approved.

With an ETF, for the first time, large institutional investors could invest in gold as easily as clicking a button to buy stocks. After the gold ETF was launched in the USA, the gold price almost tripled and has never come back down.

We cannot guarantee that the price of Bitcoin will triple after an ETF; we cannot even predict that the price will rise or fall by 10%, but having an ETF and institutional Wall Street investors brings a legitimacy to cryptocurrency that has never been there before.

Interestingly, we will likely see a spot Bitcoin ETF approved on Wall Street before there is even any crypto legislation in the USA. Will this be like driving a car in the early days, when there were no road rules? (The first automobiles roared around New York in the 1880s; road rules and speed limits were introduced in 1903…)

Several other countries have enacted legislation to legitimise cryptocurrency as an asset, commodity or currency. There are regulations around tax and asset protection for crypto in many nations, but the USA has been slow to define any meaningful laws as yet. We guess the government will have to move fast, and things may get broken in the process. Some crypto projects that are seen to be compliant may increase massively in value, whilst others that are seen to be non-compliant may plummet, all before the ink is dry on the rule book. Exciting times are ahead.

Altcoin Adventures:

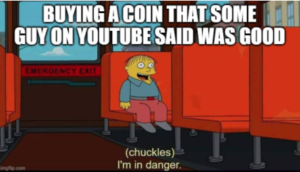

Altcoins had their own rollercoaster ride in December. From Ethereum’s network upgrades to the exciting developments in decentralised finance (DeFi), it’s clear that innovation remains at the heart of the cryptocurrency space. As we navigate through the diverse altcoin landscape, strategic investments in promising projects prove crucial for long-term success.

Despite the Binance CEO stepping down and Binance being fined $4 billion for inadequate KYC, Binance Coin (BNB) has maintained its position as a key player, driven by the success of the Binance Smart Chain and various ecosystem developments. Even after all the bad press, BNB ended the year slightly higher.

Old-school ETH alternative Solana (SOL) made headlines with its robust blockchain and adoption in decentralised applications (DApps). The native SOL coin in our DARTcoin portfolio ended the year up 964%, and it was not even the star performer!

Honourable mentions go to Fantom and ThorChain, up 241% and 398% respectively. The overall portfolio champion was Render, up 1058% for the year.

While the altcoin market offers exciting possibilities, it is important to approach it with a strategic mindset. Diversification, staying informed about project developments, and adjusting the portfolio according to market conditions remain key principles in navigating the ever-evolving landscape of alternative cryptocurrencies.

The cryptocurrency market is dynamic, and its fluctuations provide both challenges and opportunities for newbies as well as for experienced investors. We continue to monitor key updates and consider portfolio adjustments based on the ongoing developments in this fast-paced environment.

After what we assume will be a successful Bitcoin ETF launch, there are already plans in place for an Ethereum ETF, and an XRP ETF, so we may see more altcoin projects become legitimate Wall Street investments very soon. Whilst this is exciting in the short term, remember: with institutional investment comes institutional behaviour.

Markets may be manipulated by large players with trillions of dollars to invest, and it is also possible that price action may be significantly less exciting than it has been in the past. Over the last decade, crypto markets have seen rises of 10 000+% (and massive crashes of 99% or more) whilst stock markets have been tamer with fluctuations of 10-30%. The future of crypto in the next decade may be more reliable and less exciting; you have been warned

DeFi Dazzles:

Decentralised finance continued to dazzle with its groundbreaking solutions. From lending and borrowing platforms to decentralised exchanges, the DeFi ecosystem is evolving at a rapid pace. Staying informed about these developments is key for those looking to capitalise on the transformative potential of decentralised finance.

For those who have time and wish to dive deeply into some of the projects, we continue to provide updates on dozens of altcoins at www.Cryllionaire.com.

Looking Ahead:

As we step into the exciting unknown of 2024, the team at Boston Trading Co. remains committed to guiding you through the ever-changing world of the cryptocurrency market. Stay informed, stay diversified, and like all good puppies, keep your eye on the ball

We wish you a prosperous 2024!

JB

As at Dec 30 2023

BOS NAV AUD 86.9894211787

BOS Price AUD 95.6883632966

BOS NAV USD 59.1568039193

BOS Price USD 65.0724843112

Dec 30 2023

DART NAV AUD 187.51826

DART Price AUD 206.27009

DART NAV USD 125.80816

DART Price USD 138.38764

Questions, comments, let us know. Remember to always crypto responsibly. The above is general information, not advice and is best shared with friends.